Brief:

- About two-thirds (67%) of surveyed consumers in the U.S. said they're likely to shop at a retailer that offers mobile coupons over one that doesn't, according to consulting firm BRP. Some retailers are responding to that preference, with 40% indicating that offering coupons and discounts is a key feature of their respective mobile apps and websites.

- Forty-one percent of consumers plan to shop more frequently on their phone or tablet in the next two years, while the same percentage of retailers plan to improve their mobile shopping experience to meet those customer expectations, the survey found.

- Nearly 40% of those surveyed said they're comfortable with mobile identification when they walk into a store if it means a more personalized experience. However, 61% of retailers said they plan to use mobile identification through customers' smartphones and Wi-Fi, per BRP.

Insight:

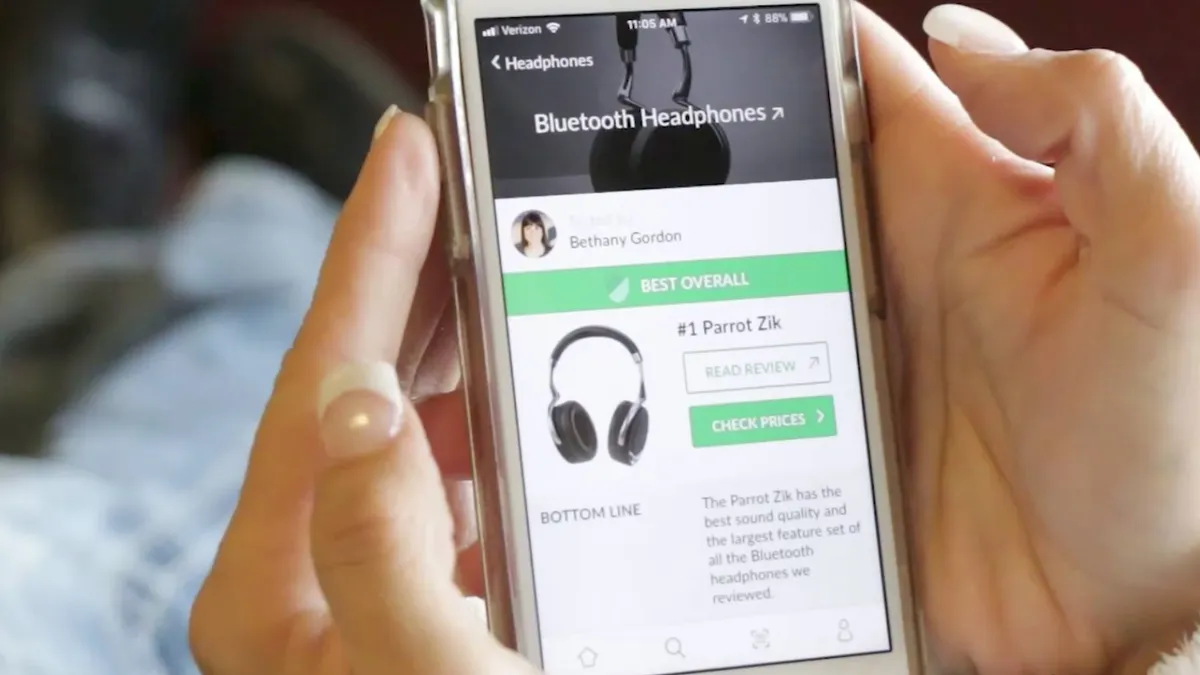

BRP's findings indicate that smartphones continue to evolve as a shopping platform and personalization engine, in addition to their role for voice calls, text, gaming, media consumption and social media usage. Consumers are growing to expect a frictionless "bricks and clicks" shopping experience without disruptions among individual channels or locations. Smartphones have become a key part of the shopping journey for many U.S. consumers, with 34% saying they use their phone to compare prices while in store and 28% looking for coupons, BRP found. Another 64% said they choose a store based on the availability of product details on a mobile device. A separate survey by RetailMeNot found that 85% of U.S. consumers still shop regularly in physical retail stores, but they use their mobile phones as a tool to help them make purchasing decisions.

Even when consumers buy products at a store, a retailer's digital offering affects most purchases. Providing product and service information is helpful to customers as they shop. Mobile features such as item availability (53%), product information (51%) and coupons and discounts (40%) help consumers make better choices and provide incentives to purchase from the brand, BRP said.

Retailers are responding by investing in their mobile capabilities with a current trend toward Progressive Web Apps, or websites that are optimized for mobile viewing and don't require a separate download. Just 26% of retailers said their mobile site is working well, while 42% plan to improve their existing web capabilities, per BRP. Discount retailers like Walmart and grocery chains including Kroger and Albertsons have added coupons to their mobile apps and websites to ease shoppers' journeys and bring the coupons they search for straight to their fingertips. Meanwhile, Home Depot and Sephora were the top-ranked retailers for best mobile experience, according to Forrester Research.

While customer tracking can be hazardous for retailers, given the numerous incidents of privacy breaches that have led to class-action lawsuits and government fines, some mobile consumers are willing to be tracked when they enter stores. This type of mobile identification supports a range of personalization features, including product recommendations that consumers have come to expect when they shop on digital channels like Amazon. Retailers need to demonstrate the value of being tracked to boost consumer adoption. The most popular incentives to support customer tracking are loyalty points/dollars (41%), specialized offers and discounts (34%), product incentives (27%) and credit toward future purchases (26%), BRP said.