Even as the novel coronavirus continues to spread around the globe and civil unrest surges in the U.S., analyses indicate that ad spending has potentially hit bottom, positioning the battered marketing sector for a rebound in Q3. Through months of turmoil, CMOs have proven surprisingly resilient and frequently savvy, using a period of deep uncertainty to realign their brands around purpose, provide essential goods and services or simply act as a voice of reason at a time when disinformation is high. Still, as things start to reopen, brands are returning to a world where almost all facets of business have been fundamentally reset, including how they engage consumers.

"What COVID did is force a lot of marketers to step back and rethink relationships with consumers," Bob Liodice, CEO of the Association of National Advertisers (ANA), told Marketing Dive in a phone interview. "There was an amazing turnaround in marketing messaging that took place. Our analysis has shown that the relationship between consumers and brands has, in fact, strengthened."

Despite some of the optimism starting to shine through after a prolonged period of doom and gloom, the long-term picture for marketers could be less than sunny. Several analysts interviewed for this story doubted that the job has become simpler or easier, and many emphasized that the pandemic previews how brands will need to continue to be nimble in navigating future crises.

From internal operations to consumer-facing messaging, key aspects of marketing have become a moving target marked by a volatility that could persist even after the current health crisis abates. It's a precariousness embodied by how fast the national conversation has flipped from focusing on COVID-19 to racial justice in the wake of mass protests over the death of George Floyd while in police custody. At the same time, the pandemic has deepened internal collaboration and accelerated response to such pressing issues, suggesting that savvy marketers could still meet the challenges of a remade landscape.

"Agile as a principle has been overplayed in recent years, but this year actually has been the year where it's really being tested," Ewan McIntyre, VP analyst of Gartner's marketing practice, told Marketing Dive in early June. "I don't just think that's COVID. I think we've seen this over the last 10 days [of protests], about brands having to be super agile in the way that they think about how they position themselves and what they mean.

"Part of that is about what you mean as a brand, and part of this is having the agility to be able to understand quickly unfolding situations and respond to them appropriately," McIntyre added. "We need to make sure that we don't lose momentum with that."

Is austerity coming?

Marketers might encounter troubles preserving momentum if resources shrink. Yet, CMOs have not been rocked as hard as some might have expected at the outset of the pandemic, even as their average tenure continues to slide.

"It's not a universally negative situation," McIntyre said. "There's a fairly significant chunk who have grown their budget in 2020. You could totally see [why] this would be the situation if you think about the ramping up of messaging across a whole bunch of different industry verticals."

The ANA has similarly detected confidence among its member marketers. Thirty-six percent of CMOs surveyed by the group have increased their technology investments in recent weeks, Liodice said, and 12.5% have upped their media budgets.

"Granted, they're smaller numbers. It means that a lot aren't doing those things," Liodice said. "But if some are doing it now, as conditions continue to improve, I think you'll again start to see the pendulum swing the other way."

Though the economy is showing some bounce back, other analysts were unsure the outlook for marketers will stay positive in the months ahead and stretching into 2021.

"The behaviors of understanding that this is a longer-term financial and budgetary challenge haven't hit home."

Ewan McIntyre

Gartner, VP analyst

Per McIntyre, CFOs and other financial stewards will likely switch from preserving cashflow — a necessity born of the hard early days of the pandemic — to again prioritizing growth and profitability, a mindset that was putting pressure on marketers before the coronavirus.

"The behaviors of understanding that this is a longer-term financial and budgetary challenge haven't hit home," McIntyre said. "I don't want to be bold as to say it will be a period of austerity, but I think there's going to be a period at least where things are tighter than they have been in the past.

"You don't have to be in the airline industry for this to be consequential," McIntyre added.

It's also not out of the question that some of the usual indicators of economic health are misleading at the moment, potentially creating a false sense of confidence. Impressive stock market gains of late, for example, can belie a hard truth: that the pandemic and its consequences are still in their early days, and the types of wide scale solutions that will expedite a return to normalcy are not yet in the picture.

"With the exception of a few companies who find themselves on the right side of pandemic serendipity, no matter how you cut it, consumer spending will shrink, budgets will be tight, and, as predicted by Forrester, marketing spending will be down — the extent of which will depend on how scenarios with treatments, vaccines, [and] immunity play out," Dipanjan Chatterjee, VP, principal analyst at Forrester, said in emailed comments to Marketing Dive.

A precarious direction for the economy moving forward puts the onus on marketers now to plan for multiple different outcomes and how each — from a significant recovery to none at all — will ladder down into all aspects of their business.

"We need to be very adept and flexible at finding what the various options are going to be out there for us and we need to be prepared from a planning standpoint as to what we do under all those scenarios — from a media investment standpoint, from an employee management standpoint, from an agency management standpoint," Liodice said.

A remote future

Regardless of how the economy shapes up, day-to-day marketing operations will look markedly different than they did before COVID-19, potentially forever.

Remote work supported by digital communications apps like Zoom has gained mainstream acceptance, and companies including Facebook and Twitter plan to allow employees to work from home in perpetuity. Some consumer brands will follow that lead, as CMOs realize that a remote setup is not always a barrier to collaboration and can, in some cases, actually speed up production.

"There's an acknowledgment that there is a great degree of efficiency in the way we are operating as businesses and as brands," Liodice said. "A good chunk of this is going to remain. The way that we do business will be fundamentally altered."

The recognition that internal marketing teams can work closely despite the physical distance is likely bad news for external agencies, which have already been hammered by layoffs and cost-cutting measures as a result of the pandemic. A recent Forrester forecast suggests agencies could shed as many as 52,000 jobs in the next two years as in-housing and gig economy alternatives proliferate, compounding on woes that were prevalent for the category pre-pandemic.

That's not to say that large agency conglomerates will collapse. McIntyre noted many CMOs still value the institutional trust, scale and variety of services the major holding groups can provide. But when it comes to more curated services that are pricey or time-intensive to develop in-house, a bigger spotlight could be put on independent or boutique firms.

"You may well see ... a shift to some partners who are able to perhaps do this at a lower-cost base and in a much more agile way as well," McIntyre said.

Production studios, like many agencies, have also seen new business dry up as a result of the pandemic. Yet, brands have not stopped creating fresh campaigns, with new efforts leveraging assets like archival footage, DIY tactics and animation to get by in the absence of in-person shoots.

"There has been an enormous amount of creativity. Everybody was forced to transform to a virtual environment," Liodice said.

While a good deal of regular production work will likely snap back — Liodice estimated between 50% to 60% in the near future — new efficiencies discovered during the pandemic could become ingrained in marketing playbooks over the long haul.

"A good chunk of this is going to remain. The way that we do business will be fundamentally altered."

Bob Liodice

Association of National Advertisers, CEO

One crucial aspect absent from the remote setup might still leave marketers — and particularly young talent — eager to get back to the office: the community and culture that can drive real breakthrough ideas and industry connections.

"The challenge is going to be the best and brightest talent is not necessarily going to be happy just to be [sitting] in their tiny apartment in New York," McIntyre said. "I wouldn't bet the farm on everybody wanting to work remotely. It's the smart message for now, and it definitely taps into where people are, but I think this will evolve and it's bound to be a hybrid model."

Laggards left behind

That same hybridization, where digital and physical channels will further blend together, is mirrored by technology investments spurred by the pandemic. Already a bigger part of brand strategy prior to COVID-19, e-commerce has jumped to the top of the agenda for marketers looking to engage the troves of people who are stuck at home and might remain wary of physical shopping for the foreseeable future.

"As people conceptualize the future of their products, of their services and then how they conduct customer care, we're going to see a new wave of innovation."

Janet Balis

Ernst & Young, Global advisory leader for media and entertainment

Companies like PepsiCo have launched ambitious new direct-to-consumer initiatives, and even high-consideration, high-dollar categories typically outside the realm of online shopping, such as automotive, are seeing a boom in interest.

"[The pandemic] has created a dramatic acceleration, first and foremost in terms of customer behavior, and then in terms of leadership priorities, where things that I think would've taken years are now taking a matter of weeks or months," Janet Balis, Ernst & Young's global advisory leader for media and entertainment and the Americas marketing practice leader, told Marketing Dive. "Whether it's in terms of e-commerce priorities or customer data priorities to enable targeting, we're seeing a rapid acceleration."

The potential for growth in such areas is appealing, but transitioning to a digitally-minded business model has never been easy for marketers, and won't get any simpler on an expedited timeline and with greater competition in the market. COVID-19 in some ways has served as a wakeup call to those who were already falling behind, and digital Luddites will need to move even quicker than before to keep up.

"It's accelerating the pace of change for some of the laggards," McIntyre said. "There has been a really significant shift toward digital across all paid, owned and earned channels, and it's leaving less than 20% of the marketing budgets to offline now.

"I don't think that's going to snap back, but I also don't think that rings the death knell of traditional media and events," McIntyre said.

'A new wave of innovation'

While segments like e-commerce will become enshrined as new standards for marketers, other emerging channels will start to see more practical applications and consumer adoption, particularly in the mobile space.

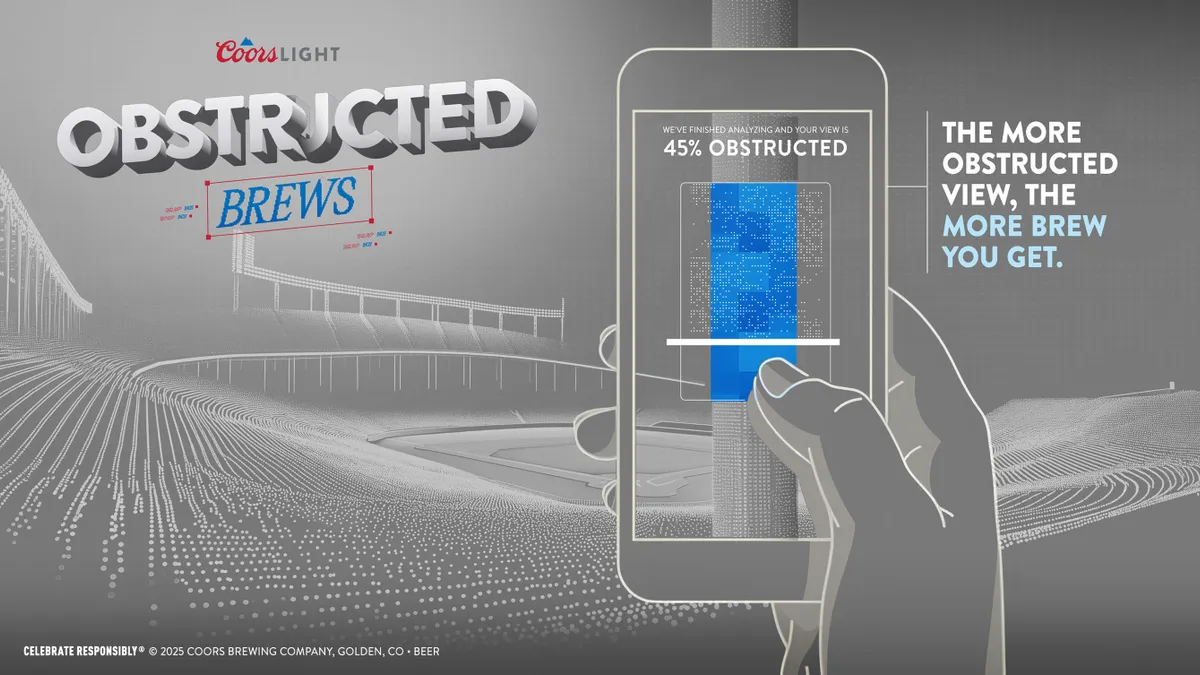

Contactless payments, long struggling to gain traction in the U.S., are starting to stick as anxious and health-conscious consumers look to avoid handling cash, while tools like augmented reality (AR) are providing greater utility in both consumer-facing campaigns and supply chains. Lowe's, for instance, recently launched a video chat tool that provides professionals with virtual consultations that are guided by AR and computer vision technology.

"These boundaries that we saw between the physical and digital worlds are becoming more blurred," Balis said. "What does that mean in terms of the opportunities to do self-service kits, explore the possibilities of augmented reality, think about a brand experience rich with content that can be delivered differently?

"As people conceptualize the future of their products, of their services and then how they conduct customer care, we're going to see a new wave of innovation," Balis added.

But in the same way that some opportunities have seemingly emerged overnight, others can disappear just as quickly. Analysts continually reinforced that the types of 12- to 20-month media planning and investment cycles marketers relied on in the pre-pandemic days simply might not be suited for the industry's "new normal" — and whatever disrupts it next.

"It's been a year of unprecedented change in 2020, but there's going to be other change ahead," McIntyre said. "If it's not COVID and it's not the challenges we've had over the last 10 days, it's going to be the climate crisis."