Hennessy, The Macallan make top 10 in L2 spirits report

A divide continues to grow among spirits brands, with some excelling in the digital space and others dawdling, according to a new report by L2.

Brands faltered on many basic levels such as adding retail locators to Web sites, but showed prowess when it came to creating social campaigns, especially on YouTube. As global campaigns proliferate, previously marooned television spots and print ads will link with digital efforts to create more brand unity.

"Brands are definitely moving forward," said Colin Gilbert, lead researcher of L2's report, New York. "But the point is that there is a bifurcation between brands that are over investing and expecting digital to have a large ROI down the road and brands that are still adhering to a wait-and-see approach.

"Increasingly, spirits brands are starting to wake up to some of the more tactical investments they have to make to push consumers from brand properties toward destinations where they can purchase products.

"However, [digital] has ushered in a new era of questions from official bodies that could enact more stringent regulations, which has created a period of uncertainty."

L2's Spirits 2014 Digital IQ Index studied 68 global spirits brands. Rankings were determined according to the following criteria: 30 percent Web site, 25 percent digital marketing, 15 percent mobile and 30 percent social media.

Industry heritage

Mr. Gilbert stressed that understanding the idiosyncratic regulatory system of the alcohol industry sheds light on brand behavior. Rather than following government strictures, alcohol companies enact self-imposed guidelines.

One of the most common stipulations is the 70 percent rule, which says that brands should only advertise in situations where at least 70 percent of the expected audience is of legal drinking age. With conventional mediums such as television, measuring the audience is easy. TV advertising continues to boom, with a 35 percent increase since 2010.

Alfred Dunhill's Traveler's Trunk for Johnnie Walker

Digital, on the other hand, represents a murkier playing field. A lack of consensus, easy to sneak by age-gates and a microscopic view of audience demographics has stifled the activity of some brands that do not want to trigger regulatory retaliations.

Thirteen percent of television spots ended with a hashtag and one third ended with a URL, indicating that brands are reluctant to marry channels with a simple call to action.

That being said, spirits brands are not operating in some cage. Many innovative players have emerged in the past few years.

"Its an exciting industry," Mr. Gilbert said. "A lot of brands are doing remarkable things online and as the industry shifts even further, they will have a tremendous head start over the brands that are cautious."

<em style="font-size: 13px;">L2's Spirit report</em>

<strong>A few high and low lights

</strong>Bacardi grabbed the top spot in the report for its mobile- and tablet-optimized Web site, compelling events including the "Great Urban Race" and diverse advertising across digital platforms.

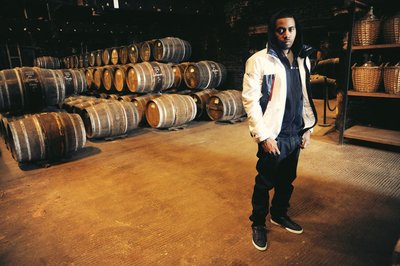

Hennessy came in fourth due to the sustained integration of brand ambassador Nas and a new email marketing program. The brand constitutes 49 percent of Moët Hennessy's case volume.

<a href="http://www.luxurydaily.com/wp-content/uploads/2013/07/hennessy.nas_.jpg"><img width="400" height="266" title="hennessy.nas" class="alignnone size-full wp-image-70273" src="http://www.luxurydaily.com/wp-content/uploads/2013/07/hennessy.nas_.jpg" />

</a><em>Nas for Hennessy</em>

The Macallan rose 37 percent from the year-ago period to seventh place because of its clean Web site redesign and resilient photo contest.

<a href="http://www.luxurydaily.com/wp-content/uploads/2014/03/macallan.sxsw-instagram-.png"><img width="400" height="351" title="macallan.sxsw instagram" class="alignnone size-full wp-image-91401" src="http://www.luxurydaily.com/wp-content/uploads/2014/03/macallan.sxsw-instagram-.png" />

</a><em>The Macallan Instagram feed during South by Southwest</em>

Scotch brands had the highest average digital IQ, while tequila brands scored the lowest.

Eighty-eight percent of brands feature cocktail recipes on their Web sites and 87 percent feature video content. No more than 35 percent of brands carried the other Web site functions that were looked for including keyword search, retail locator and buy online options.

The lack of purchasing directives owes primarily to the three tier rule which calls for distribution to go through producers, distributors and then retailers before reaching the consumer.

Nonetheless, directing consumers to online retailers and providing a physical store locator would undoubtedly boost sales and does not violate the traditional arrangement.

<a href="http://www.luxurydaily.com/wp-content/uploads/2013/10/macallan.lalique-collection.png"><img width="400" height="206" title="macallan.lalique collection" class="alignnone size-full wp-image-78125" src="http://www.luxurydaily.com/wp-content/uploads/2013/10/macallan.lalique-collection.png" />

</a><em>Lalique designed Macallan bottles</em>

Account sign-ups persist as another underutilized area. Branded accounts can help consumers make online purchases and enable valuable data collection.

While 71 percent of Web site traffic originates from search portals, brands have floundered when it comes to setting up a path to purchase through search results.

Brands duke it out over "long-tail" paid search results such as "How to make drinks" and "Gin and juice," but flag when it comes to gaining visibility on key retailers such as Bevmo! and Total Wine & More.

Mr. Gilbert said that when Amazon begins selling spirits, brands will change how they approach first page results.

"There is very little sophistication about how brands understand their page listing," Mr. Gilbert said.

"You often pull up hundreds of results and only 10 to 12 appear on that first page," he said. "It's analogous to how brands vie for position in a store from shelf an aisle placement.

"Once Amazon gets into the game it will really challenge and compress the conventional view of the three tier system."

</p><p><strong>Final Take</strong>

<em>Joe McCarthy, editorial assistant on Luxury Daily, New York</em></p><p><em> </em>

<iframe width="420" height="236" src="//www.youtube.com/embed/0yeaefe0fDk" frameborder="0" /></p></body>

</html>

L2?s Spirit report

A few high and low lights

Bacardi grabbed the top spot in the report for its mobile- and

tablet-optimized Web site, compelling events including the ?Great Urban

Race? and diverse advertising across digital platforms.

Hennessy came in fourth due to the sustained integration of brand ambassador Nas and a new email marketing program. The brand constitutes 49 percent of Moët Hennessy?s case volume.

The Macallan rose 37 percent from the year-ago period to seventh place because of its clean Web site redesign and resilient photo contest.

The Macallan Instagram feed during South by Southwest

Scotch brands had the highest average digital IQ, while tequila brands scored the lowest.

Eighty-eight percent of brands feature cocktail recipes on their Web sites and 87 percent feature video content. No more than 35 percent of brands carried the other Web site functions that were looked for including keyword search, retail locator and buy online options.

The lack of purchasing directives owes primarily to the three tier rule which calls for distribution to go through producers, distributors and then retailers before reaching the consumer.

Nonetheless, directing consumers to online retailers and providing a physical store locator would undoubtedly boost sales and does not violate the traditional arrangement.

Lalique designed Macallan bottles

Account sign-ups persist as another underutilized area. Branded accounts can help consumers make online purchases and enable valuable data collection.

While 71 percent of Web site traffic originates from search portals, brands have floundered when it comes to setting up a path to purchase through search results.

Brands duke it out over ?long-tail? paid search results such as ?How to make drinks? and ?Gin and juice,? but flag when it comes to gaining visibility on key retailers such as Bevmo! and Total Wine & More.

Mr. Gilbert said that when Amazon begins selling spirits, brands will change how they approach first page results.

?There is very little sophistication about how brands understand their page listing,? Mr. Gilbert said.

?You often pull up hundreds of results and only 10 to 12 appear on that first page,? he said. ?It?s analogous to how brands vie for position in a store from shelf an aisle placement.

?Once Amazon gets into the game it will really challenge and compress the conventional view of the three tier system.?

Final Take

Joe McCarthy, editorial assistant on Luxury Daily, New York