Dive Brief:

- Medium CEO Evan Williams announced that the publishing platform will launch a consumer subscription product this quarter as a new revenue stream, as reported by TechCrunch.

- At the start of the year, Medium laid off around one-third of its staff, closed offices in New York and Washington D.C. and said it was dropping its ad-based business model entirely. Medium was founded on the idea of revolutionizing the way digital publishing works, but had recently adopted more traditional formats like sponsored posts to help monetize its product.

- In separate but related news, Digiday reported that The Wall Street Journal sent out an online survey to subscribers seeking input on a range of new revenue possibilities including launching an ad-free version of the digital platform, charging on a per-article basis and possibly charging extra for home delivery.

Dive Insight:

The Medium news is both more concrete and more interesting — while The Wall Street Journal was just surveying its readers about potential new strategies, Medium's plans come straight from CEO Williams, who's said in the past that ad-driven digital media exists in a "broken system." Medium was partially built around formulating a fix for that system, but a paid subscription service is neither particularly revolutionary nor a guaranteed win. Digital readers are far too accustomed to free content to fork over money for anything other than stellar and truly distinct offerings.

Formats like native have been proposed as a replacement to less effective display units, but publishers are struggling to properly implement and measure things like sponsored posts for their advertising partners, as Medium's dropping of the format highlights, and native ad renewal rates disappointed last year. Easy answers for publishers remain elusive, but it will be interesting to see how Medium’s move and the Journal’s eventual direction pan out.

Although Medium is a new, digital-only publishing upstart and The Wall Street Journal is a venerable brand founded 127 years ago, the fact these two polar opposites are facing down the same issue is telling. Ad blocking software adoption continues to cut into publishing business models, and the way people actually consume publishers' content is evolving as well.

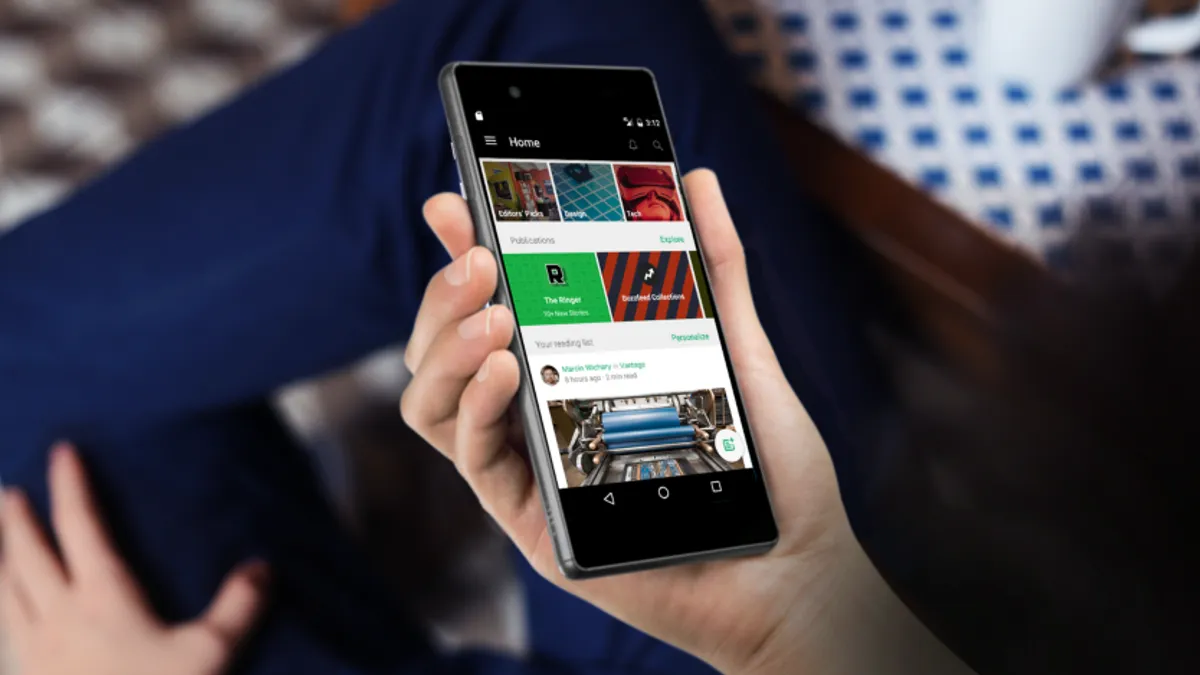

Last year, Pew Research published studies that found around 44% of U.S. adults were getting their news from Facebook, and mobile distribution options like Apple’s Instant Articles and Snapchat’s Discover portal place content away from publisher’s main digital properties, even if both do offer revenue opportunities.